In retrospect, 2016 ended with lower rent per square foot when compared to December 2015. Rents in the December 2016 matched the annual average of 76¢ per square foot and were 1¢ less per square foot than realized one year prior.

This overview utilizes NTREIS data on leased properties in Abilene, Texas. This data provides 13 months of data spanning December 2015 to December 2016, allowing the user to look across these months at changes in rental prices, days on market and inventory available town wide, both by school district and by ZIP code. The percentage changes calculated in this table compare the current month’s statistics to an average of the last 12-months and the data from the same month in the 2015.

The decline in rent becomes more pronounced if we consider the rent per square foot in real terms. In December 2015, the 12-month average for rent was 75¢. In December 2016, this 12-month average for rent was 76¢. During 2016, housing market inflation grew by 3.63% which devalues this 1¢ gain in rent per square foot.. Using the seasonally adjusted CPI index for housing to correct for inflation, the December 2015 12-month average would 78¢ per square foot for a real 2¢ drop in the 12-month average during 2016.

Factoring this price per square foot drop on a 1,444 square foot house – the average single-family rental size for 2016 – you lose $28.82 per month or $345.84 per year. Couple this with the fact that the 12-month average in vacancy between December 2015 and 2016 grew by 8 days, you could add $283.21 (= 8 x (.76 x 1,444)/31) to your annual loss for a total annual decline in rent of $629.04 Assuming insurance, taxes, debt service and maintenance run at the same pace, this loss in rent is subtracted, dollar for dollar, from net income. If you demand a 10% cap, this same rent house is worth $6290.40 less today than a year ago.

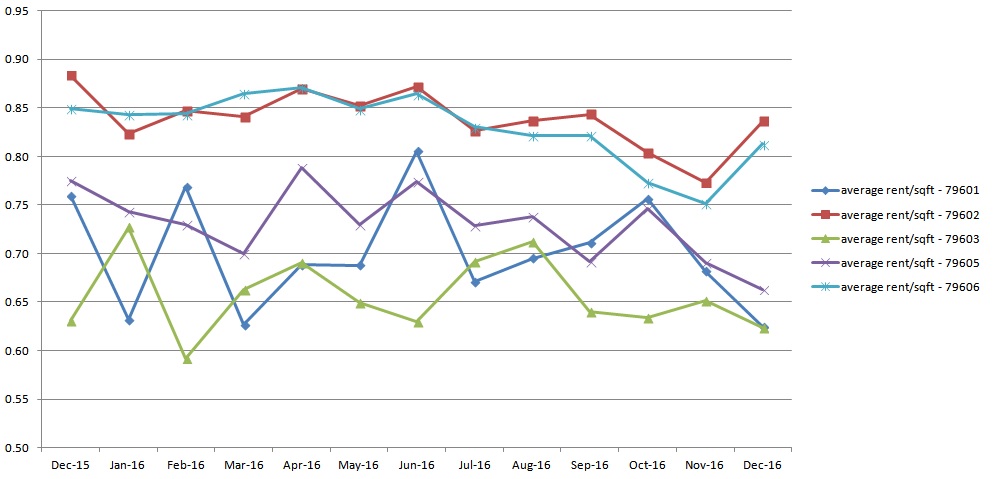

Looking at 2016 inflation-adjusted figures by ZIP code in the above graph, we see two stories emerge. Rent houses in 79606 and 79602 had higher and more stable rents across time than rentals in 79601, 79603 and 79605. This stability can be explained, in part, by the newer inventory of rentals in 79606 (average age 27 years) and 79602 (average age 36) compared to the average age of 45 years for Abilene rentals. The stability in rent may also reveal a preference for the Wylie ISD that serves 79602 and 79606. 79601’s instability is due to nothing more than a limited monthly data – when 2 homes are driving the rent/sqft story for December 2016, one outlier can swing the outcome. One unifying observations is that all ZIP codes finished the year at a lower, inflation-adjusted price per square foot than what was realized one year ago.

Looking back at historical data tabulated for Abilene since January of 2013, there are 14 consecutive comparison periods where homes leased slower than same month in the previous year. November 2016 rentals marginally reversed this trend with a 1-day gain in diminished days on the market. December 2016 reintroduced this trend with homes remaining on the market 9 more days than the what was realized in December 2015.

While rentals in all ZIP codes and school districts realized more time vacant when compared to the prior month, 79603 leased the fastest with only a month without a tenant. 79602 fared the worst at 49 days on the market. For the final quarter of 2015, 79602 rent houses sat empty longer with each month that passed.

On the aggregate, average total December 2016 rents rose $158 from the previous month. This is understandable as homes leased in December 2016 were larger (+28 sqft) and newer (-7 years) than homes leased in November 2016. Security deposits, a measure of rental quality, trended with rent increasing $214for a 5.6% gain when compared to the 12-month average. Pet deposits between November and December fell 1% against the 12-month average with a 15% gain in the number of rentals leased to pet owners. It appears landlords were being concessionary by leasing to pet owmers to combat the days the rental sat vacant.

According to NTREIS, 81 single-family homes were leased in December 2016. These units leased at, on average, 76₵/square foot and were sized at 1,466 square feet. Consequently, these leases are estimated to deliver a December 2016 value of $90,246 to the Abilene economy. Considering the coming 12 months and the leases executed during November 2016, these leases potentially account for a $1,082,963 annual contribution to Abilene’s economy.

Leave a Reply