Taylor CAD maintains a database of taxable properties that date back to 2003. This data is updated annually for the collection of property taxes. The most recent valuation year is 2017 and provides square footage, lot size, age of property and exemptions for the calculation of property taxes.

The homestead exemption is can be claimed by homeowners that claim property as their primary residence. The homeowner benefits from the homestead exemption through reduced property taxes. This benefit encourages property owners to claim the exemption when they can. If they don’t, the assumption is that this residence is not homestead, but, instead, it is a rental.

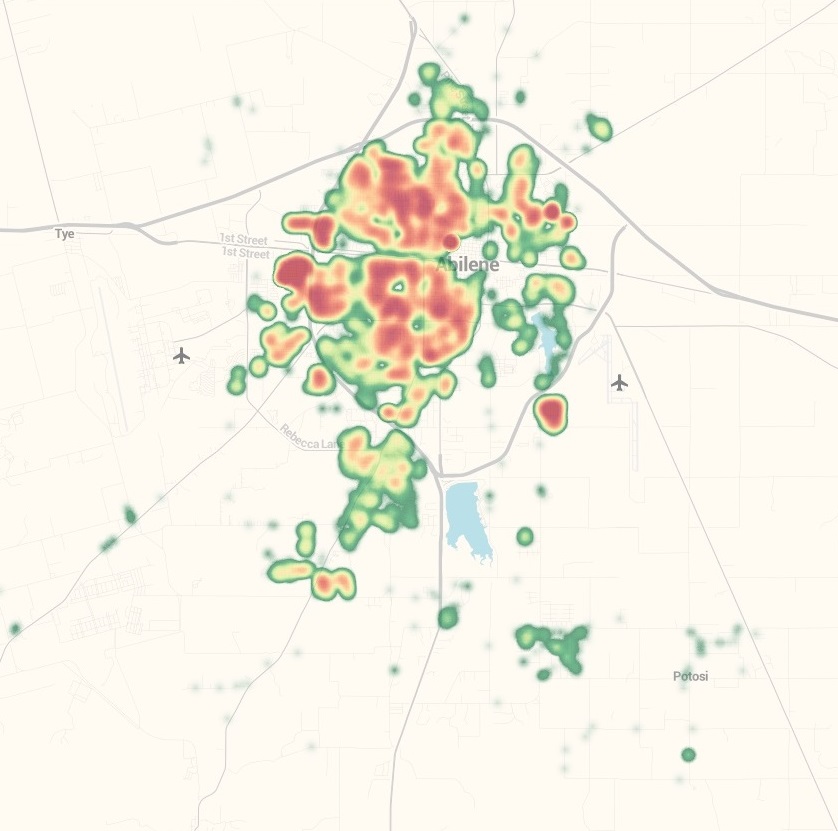

The image below represent 14 years of changing land use in Abilene. Starting with 2003, we can see which neighborhoods experience an increase in rentals. Low rental density is shown in green, mid-range rental intensity is shown in yellow and a high level of rentals is shown in red. The image also gives us the opportunity to observe development in south Taylor county – note the growing density to the west of Potosi and southeast of Lake Kirby as new neighborhoods develop in Wylie ISD.

Leave a Reply