by John Hill

DOES COMMISSION MATTER?

The other day, a fellow real estate agent told me this anecdote: following negotiations with the homeowner, an agent lists a house for a commission fee. As listing agent, he markets the house and his efforts are rewarded when an interested purchaser is identified through another agent. The listing agent and buyer’s agent approach the contract’s finalization, but before the deal is inked, the buyer’s agent brought one final negotiable to the deal. He said: “You can take it from your commission or you can negotiate an additional percentage with your seller, but I need 1% more in commission for my efforts before we contract this deal.

This interchange by the two parties raises the question: do increased commissions engage the interest of real estate agents? What sort of response would we see from the buyer’s agent if his demand wasn’t met? The request almost suggests the buyer’s agent views all homes as fungible and that he direct buyers to homes that meet his need as the agent (ignoring those of the principal).

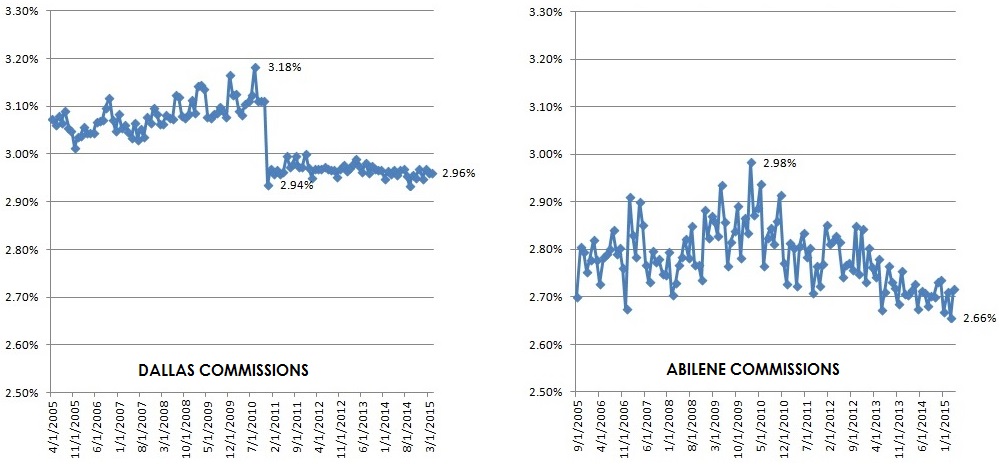

Part of these 11th hour negotiations might be reconciled to frustration and a touch of envy over commissions realized in markets outside Abilene. Commissions on single-family home sales in both Dallas (based on 106,379 sales dating back to 4/1/2005) and Abilene (based on 13,765 sales dating back to 9/1/2005) have changed over the last 10 years, but Abilene commissions appear less stable and prone to variation when compared to the Dallas market. The two plots of buyer-side commissions illustrate this point.

These buyer-side commissions represent one-half of the total commission earned on a real estate transaction, with the listing agent typically earning an identical percentage. These graphs allow one to make the following observations regarding buyer-side commissions:

- Dallas commissions are stable with one market reset in 12/2010. Average buyer-side commissions dropped from 3.08% pre-12/2010 to 2.97% – a difference of .11% in the months to follow.

- Pre-2010 Dallas commissions peaked at 3.18% in 9/2010 and a post-2010 commission that saw a low of 2.94% in 1/2011 – a margin of .24%.

- Abilene commission are volatile and, since the last quarter of 2010, have trended downward. Prior to 12/2010, the standard deviation in monthly Abilene commission rates was, roughly, double that of Dallas commissions; after 12/2010 it was 4 times that of Dallas commissions.

- Abilene commissions peaked in 2/2010 of 2.98% and decreased by .0033%/month since that date.

- The worst commission in Dallas matches the best commission in Abilene across this entire period.

Across this 10-year period, the average, buyer-side commission realized in Abilene was 2.78% on an average home priced at $133,579. Alternately, the average Dallas commission was 3.03% on an average home priced at $267,115. The result is the Abilene agents earned $3,718 per sale for an average home while a Dallas agent is earned $8,104 per sale. Both markets require similar efforts, but the Dallas market yields twice as much for roughly the same work (and I’ll leave it to the reader to decide if this justifies the maneuverings of the buyer’s agent in my opening anecdote).

In terms of the national economy, a variety of market events are responsible for these changes in both markets. The Fannie Mae debacle in 2008, attempts at expansionary monetary policy through the manipulation of interest rates and local economic conditions drive the sale of single-family homes in Abilene and Dallas.

Still, none of these things change the objective of every real estate transaction: get it sold. Each sale recorded in NTREIS (the North Texas Real Estate Information System) looks at the DOM or days on the market from the date the property was listed until the day the property was sold. This provides a standard to analyze the factors which drive the sale of a property and address the original question: do higher commission rates cut the number of days a home remains on the market?

DOES EXPERIENCE MATTER?

This analysis also allows us to answer the question: does experience reduce the days a home remains on the market? As a relatively new brokerage, this is an important question for us. With the exception of broker Mitch Barnett, the majority of our agents have held their license less than 2 years.

I recall when I first got my license, I told a seasoned realtor that I just became an agent. I deferentially suggested that I hoped to have a fraction of the business that she enjoyed across the years. She flatly responded: “It would be impossible for you to match the skill and experience I bring to every transaction.” Without missing a beat, she explained that these skills qualified her to list my recently deceased mother’s house (which happened to be my first listing). We parted ways with me wondering: what exactly had the years given her when it came to experience?

ANALYSIS OF EXPERIENCE AND COMMISSIONS

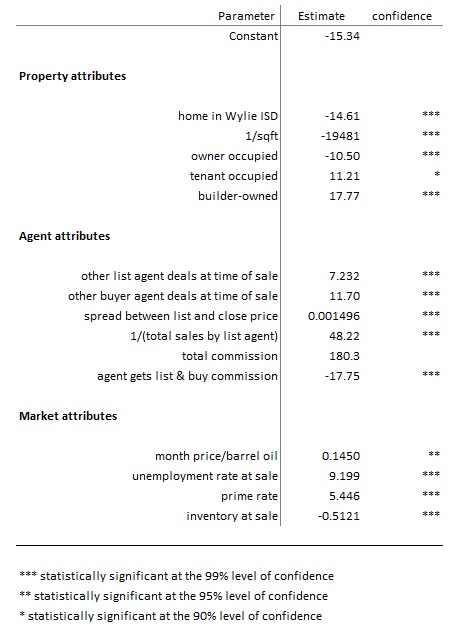

Inspired by these two exchanges and armed with historical real estate data, I used an ordinary least-squares regression to analyze the 2,678 home sales executed by Abilene real estate agents who obtained their license after January 1, 2005. The results of the regression are entabled below and classed by home attributes, realtor attributes and market attributes. The model had an R^2 of 35.4% and the asterisks in the table indicate the level of significance for each variable’s ability to confidently explain DOM. The constant – a grab bag to give value to variables unspecified in the model – was insignificant. This suggests that the model does a reasonable job of providing good fit for the question at hand.

Property attributes were expected to contribute to DOM as follows:

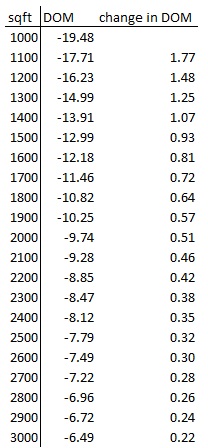

- It is assumed less square footage decreases DOM – larger houses are harder to sell. This variable is estimated using a reciprocal transformation. The purpose of this estimation is to introduce the idea that as a home gets larger, the days on the market changes at an decreasing rate.

The table below shows the relationship between sqft and DOM for homes ranging from 1000 sf to 3000 sf. According to this model 1,000 sf home sells 10 days faster (=-9.74-(-19.48)) than a 2,000 sf home and 13 days faster (=-6.49-(-19.48)) than a 3,000 sf home.

- If the home is renter-occupied, it adds 11.21 days to the sale of the home. Renters have motive distinct from the owner regarding the home’s sale.

- If the home is owner-occupied, it shaves 10.51 days from the sale of the home. Owner-occupied homes sell faster because owners have a financial stake in making the home attractive and convenient for sale.

- If the home is being sold new by the builder, it adds 17.77 days to the sale of the home. Builder-occupied homes sell slower as the builder waits for the best offer that comes closest to a price based on cost to build.

- Based on preference for school district, Wylie ISD homes sell 14.61 days faster than other Taylor County homes.

Agent attributes drive DOM as follows:

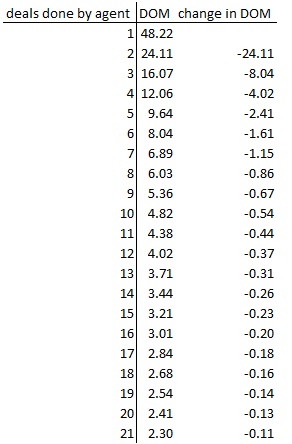

- The number of deals done by the agent prior to the sale of the house should decrease the DOM, but at a decreasing rate. Like square footage, a reciprocal transformation of the data is used to model this relationship. This captures the idea of a learning curve where the greatest gains to expertise are realized early in one’s career.

The first sale can add 48.22 additional days to a home’s DOM, but inexperience quickly fades with each sale. The table below shows inexperienced agents quickly acquire the skills needed to execute a sale. After the agent completes the 7th sale, the delay due to inexperience adds less than a day to the total DOM.

- Back to our opening anecdote, total commissions don’t matter. There is no statistically significant link between the commission rate paid and days a home spends on the market (and when that agent tells you nothing is more profound that finding the right home for a customer, it may not be an empty platitude).

- While total commissions have no statistical bearing on the sale’s pace, the agent’s ability to snare both the listing commission and sales commission does. If the listing agent finds a buyer for the property thereby keeping the entire commission, the agent hustles and the house sells 18 (≈-17.75) days faster.

- The spread between original list price and closing price adds to days on the market. If a home is overpriced by $6,685, it adds 10 days to the time the home sits on the market. Sound pricing is crucial in timing the sale of a property.

- Each listing that the agent is handling in the 75 days surrounding the close date of the property adds 7.232 days to DOM.

- Each buyer for whom the agent is working in the 75 days surrounding the close date of the property adds 11.7 days to DOM.

Market attributes drive DOM as follows:

- According to the model, the more houses on the market, they quicker your house sells which seems counter-intuitive to the notion of supply and demand. At the time of this report, there are 487 active, single-family listings in Taylor County. If this number were to grow to 500 active listings, it would reduce the time a home remains on the market by, roughly, 7 days. This underscores the absence of data to capture buyer interest which grows in the spring and trails off as we approach Christmas. If we had a variable to proxy interested buyers, we could do a better job of explaining both sides of transaction.

- Every 1% gain in the Abilene unemployment rate leads to a 9 additional days that the house remains on the market.

- A $7 increase in the price/barrel of oil causes a 1 day gain in DOM. This is surprising, given Abilene’s history in the oil market. It appears that Abilene is more of an oil consumer than an oil producer where higher oil prices dampen all markets, including that of housing.

- When the prime rate falls by 1%, DOM declines by 5.446 days. The lower cost of financing stimulates a home’s sale.

GETTING IT SOLD

This analysis looks at a variety of factors that can change the pace at which a home sells. Many are unalterable, e.g. square feet, unemployment rate, but the seller does have control over several aspects of the deal. To be explicit:

- If a home is overpriced by $6,685, it adds 10 days to the time the home sits on the market. Conclusion: use market data to devise a market price. You may have a mortgage to cover or hope to recoup all the costs of that outdoor kitchen, but recognize that this is meaningless to the buyer.

- An owner-occupied home sells 10.5 days faster because owners have a financial stake in making the home attractive and convenient for sale. Conclusion: stay put or stage your home to make it more appealing.

- A tenant-occupied home sells 11.21 days slower because the renter’s goals run counter to the seller’s goals. Conclusion: unwind your relationship with your tenant when contemplating a sale.

- Commission are a conflicted story. Commission, as a whole, don’t hasten the sale, but if the agent can get both sides of the sale, closing happens 17.75 days quicker. This demonstrates that agents respond to incentives provided by the seller. Conclusion: market data indicates commissions are negotiable, but large commissions do incent agents. Still, the seller should ask the question: was the extra 1% commission I paid worth cutting 2/3 month off my mortgage obligation?

- Agent choice is also a conflicted story. This is because there is a price that comes with choosing an experienced agent: you aren’t the only person relying on their expertise. Every listing poses an opportunity cost to the agent as they pilot an increasing number of deals towards closing. While the data indicates new agents toil an extra 48.22 days on their first deal, they bring the benefit of single-mindedness to their lone, first transaction. Conclusion: an agent’s experience is negated by a busy schedule. Don’t fret when hiring a new agent; instead, recognize the extra attention they can focus on the sale of your home. To ensure a smooth transaction, ask about the guidance provided by the agent’s broker or if the agent is part of a realtor team led by an experienced agent with skill in solving issues as you move to closing.

CLASSICAL ECONOMICS & MODERN MARKETS

To look at this last point from another perspective: the model estimates that each listing adds 7.23 days per listing to the agent’s ability to close the deal. Over the last 75 days, the average Abilene realtor had a book of 5 listings – these 5 properties add a 36-day delay (+7.232 x 5 DOM) to each transaction. Throw in the opportunity cost posed by one buyer’s agent assignment (+11.7 DOM) and you’ve added enough days on the market to handicap a seasoned agent’s pace to that of a new agent with a single listing.

This is what economists call the law of diminishing returns – a concept bandied by other early economists, but formalized by 19th century economist David Ricardo. The limitations posed by a scarce resource – the realtor’s time – cause deals done by the agent and agent commissions to grow at a decreasing rate.

When diminishing returns manifest, decisions are made by the realtor about expanding technology and inputs to keep this limitation at bay. This is application of Adam Smith‘s 18th century idea of division of labor – costs fall by subdividing tasks into smaller, easily-mastered events that can be done with greater precision and speed.

To fatten their margins, successful realtors manifest division of labor in a variety of ways. Teams of buyer’s agents, decisions about online presence, and contracts sent for electronic signatures would be examples. As the successful realtor defines his or her own brand with a team of buyer’s agents tethered to their judgement by cell phones, shared files and calendar systems to monitor deals and the promise of income that comes from their branding, the agent team essentially become a nimbler brokerage within a brokerage.

The expansion of agent teams demands revisiting our first, two graphs on commissions. Division of labor cuts costs and has the potential to fatten margins, but to realize this gain, agents must hold the line on commission rates. The current, competitive climate in real estate commissions bodes poorly for the tacit cooperation on realtor fees enjoyed with old-economy brokerages that exercised a measure of oligopolistic privilege.

As the internet eliminates barriers to entry posed by print advertising and support staff budgets, agents become more pliant on commissions. The aggregation of these small, isolated .5% to 1% concessions explain the slide in commission rates seen in in both the Dallas and Abilene market. They also signal the death knell for the classic, 7% commission realtors enjoyed in the past as the market works to discern a new equilibrium on commissions.

Much to the chagrin of realtors, Adam Smith would be delighted – in fact, I’d like to think he would include this anecdote along with stories about tanneries, banks and pin factories that fill the pages of his 1776 book The Inquiry Into & The Causes of the Wealth of Nations. As a critic of Mercantilist-era guild pricing (think inflexible 7% commissions), Smith offered that competitive markets would unleash the benefits of the division of labor as the profit motives competitively moved resources to where they were valued most, a process he called the invisible hand.

As a moral philosopher, Smith’s interest in 1776 was on the consumer; he wanted more goods at lower prices to benefit the poor people of Scotland whose plight he saw each day. Fast-forward to the winter of 2010 when the Fannie Mae debacle left desperate households shackled to pre-2008 mortgage terms. The commission reset which began in those last months of 2010 are emblematic of justice exacted on behalf of consumers by Smith’s invisible hand. A combination of homeowner’s desperation and realtors hoping to nab the listing led to concessions on their fees.

Commissions and experience matter, but in ways that tell a broader story beyond the sale of an individual’s home. Locally, lack of experience shouldn’t be a deal breaker when choosing a realtor to sell your home. Globally, a wealth of experience held by realtors subtly benefits consumers as agents and brokers respond to market conditions and technological changes with increasingly competitive commissions.

Leave a Reply