Our report on top residential landlords in Abilene provided information on 6,811 Abilene residential rentals held by 1,432 investors. These portfolios of 2 or more rent houses had a 2017 assessed value of $309,167,579. While nothing to dismiss, these single-family residential investments only comprise 7.1% of the 5,660 commercial properties in Abilene valued at $4,337,657,904.

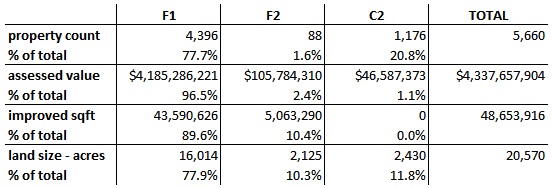

For this analysis, local commercial real estate is separated by Texas state tax property codes:

- F1 – real estate, commercial

- F2 – real estate, industrial

- C2 – real estate, commercial lots and tracts

A breakdown of appraisals for each property type is summarized in the table below:

Real commercial real estate is the most represented class of commercial real estate in terms of count, value, improved sqft and acreage. In terms of count, commercial lots and land make up 20% of the commercial property, but only 1.1% of overall assessed values. A tenth of land size and improved square footage goes to industrial real estate, but this comprises 2.4% of overall assessed value.

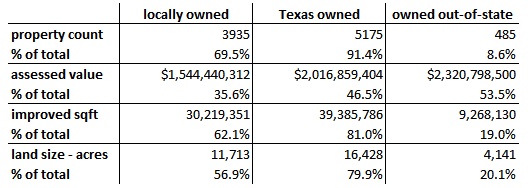

The term absentee owner is always a pejorative in real estate ownership. To get an assessment of their role in Abilene’s commercial market, this table separates appraisal records into local, state and out-of-state ownership.

More than a third of assessed value is owned locally and if one evaluates this data just by door count, more than two-thirds of all commercial real estate is locally owned. If we expand our geographic net to include all of Texas, 91.4% of all Abilene property is Texas owned. 8.6% of all commercial properties are owned out-of-state, but these 485 properties comprise 53.5% of assessed local values. Out-of-state owned properties are only 1/5th of the acreage and improved square footage held locally in commercial property, but they are over half of the value in commercial real estate.

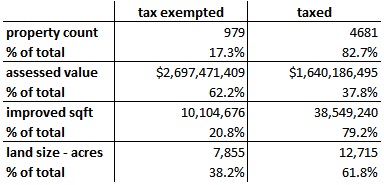

Churches, universities, public schools, Dyess AFB, along with city and county property are included in this assessment of commercial real estate, but are tax-exempt. The next table divides local commercial property into taxable and non-taxable:

When accounted by address, tax-exempt properties are only 17.3% of our local tax base, but account for 62.2% of our local commercial value in real estate. Abilene has a fair amount of institutional money – Dyess AFB, universities, hospitals, schools and other public dollars – that define our economy. This almost $2.7 billion in untaxed, non-profit real estate underscores that point.

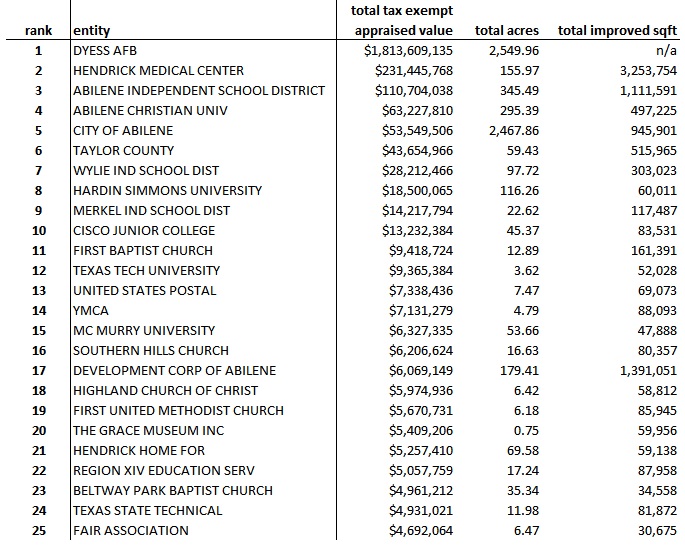

The next table shows the top 25 tax-exempt entities ranked in terms of appraised value and offers very few surprises. Dyess AFB leads this list with other major employers trailing behind; number 2 Hendrick Medical Center is 12% of the appraised value of Dyess AFB.

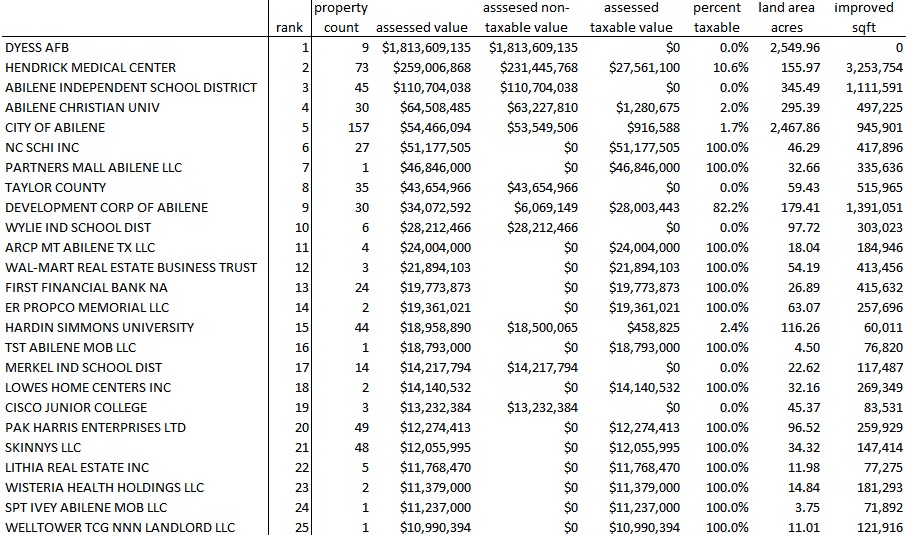

Not all property of tax-exempt entities are classified as tax-exempt by Taylor CAD. The next table shows the top 25 property owners in Abilene ranked by appraised value without distinction whether their portfolio is subject to property tax. Individual tax records were used to dignify appraised value that is taxable and this is reported both as a total and as a percentage.

For example, the DCOA is 17th on the list of non-taxable entities, but rises to 9 on the second list as 82.2% of the property they own is classified by Taylor CAD as taxable. It is interesting to note that the top five entities on this list are largely tax exempt and 8 of the top 10 entities have portfolios that are predominately untaxed. The two taxed entities in the top 10 that are subject to property taxes include:

- NC SCHI INC which is Abilene Regional Hospital and

- PARTNERS MALL ABILENE LLC is the Mall of Abilene – an enterprise that follows economic activity instead of shaping it.

ARCP MT ABILENE is the Shops of Abilene and WAL-MART REAL ESTATE BUSINESS TRUST is self explanatory. Again – retail centers follow economic activity. The top basic industry that brings money to Abilene from outside the local economy is #13: FIRST FINANCIAL BANK NA. This reiterates that Abilene’s income is driven by institutional dollars, and less by the private market.

The entire list of commercial properties is entabled for review. As presented in the table above, the top 25 commercial real estate owning entities are listed. If commercial real estate owners below ranked below spot 25 are tax exempt, their name is listed; otherwise; there name is withheld. If you’d like to know where you fall in this ranking, email or call John Hill at 325.721.4428 for more information.

Leave a Reply