THE MEADOWS APARTMENTS

Investment Overview

- Price: $2,640,000

- Improved sf of 92,088. Initially built with 136 units, one of the 3 bedroom units has been retained as the leasing office. Removing this units from the mix leaves 91,308 leaseable sf. If the owner decided to convert the office unit to residential lease space, lease office space is available at the adjacent shopping center to the east.

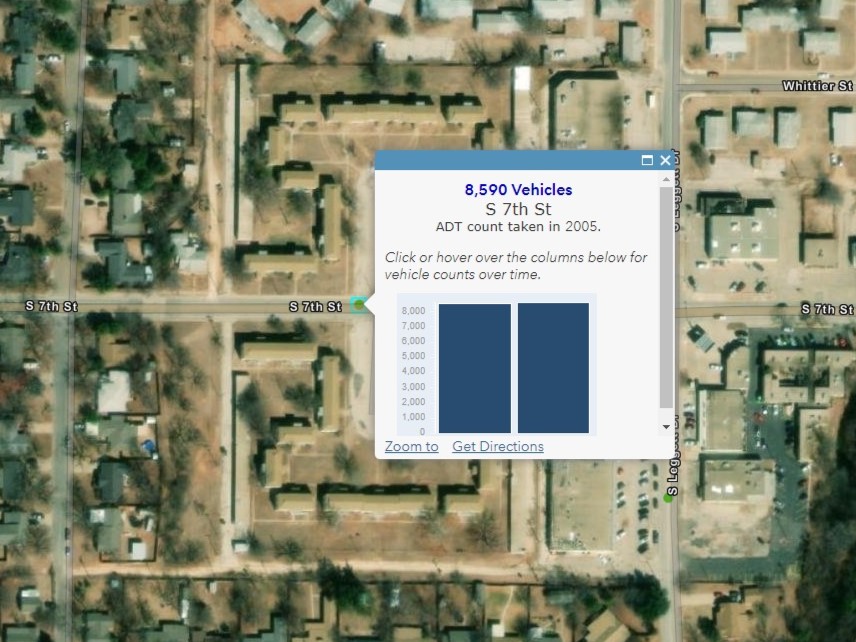

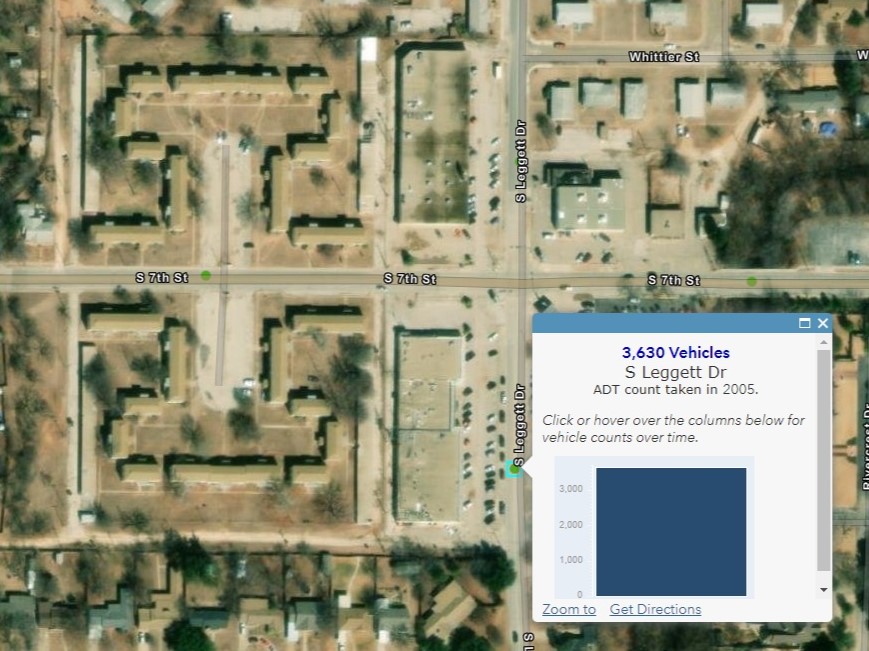

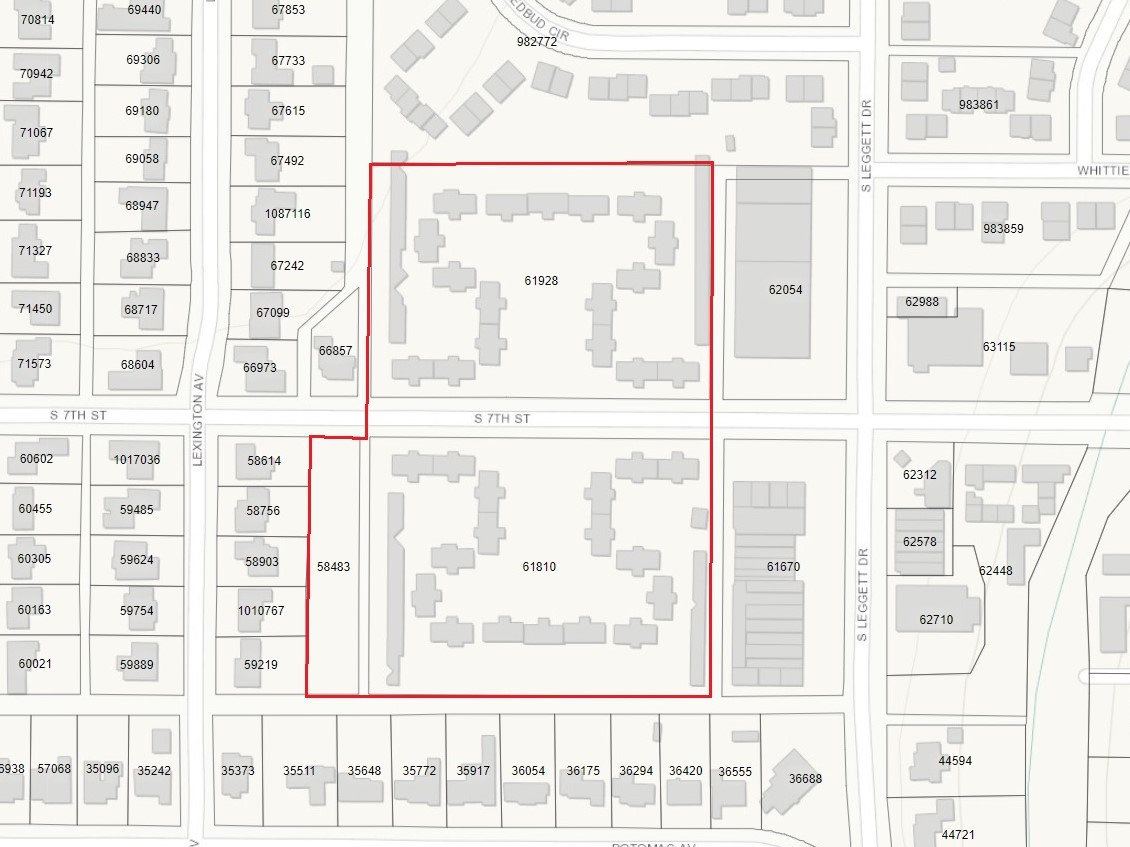

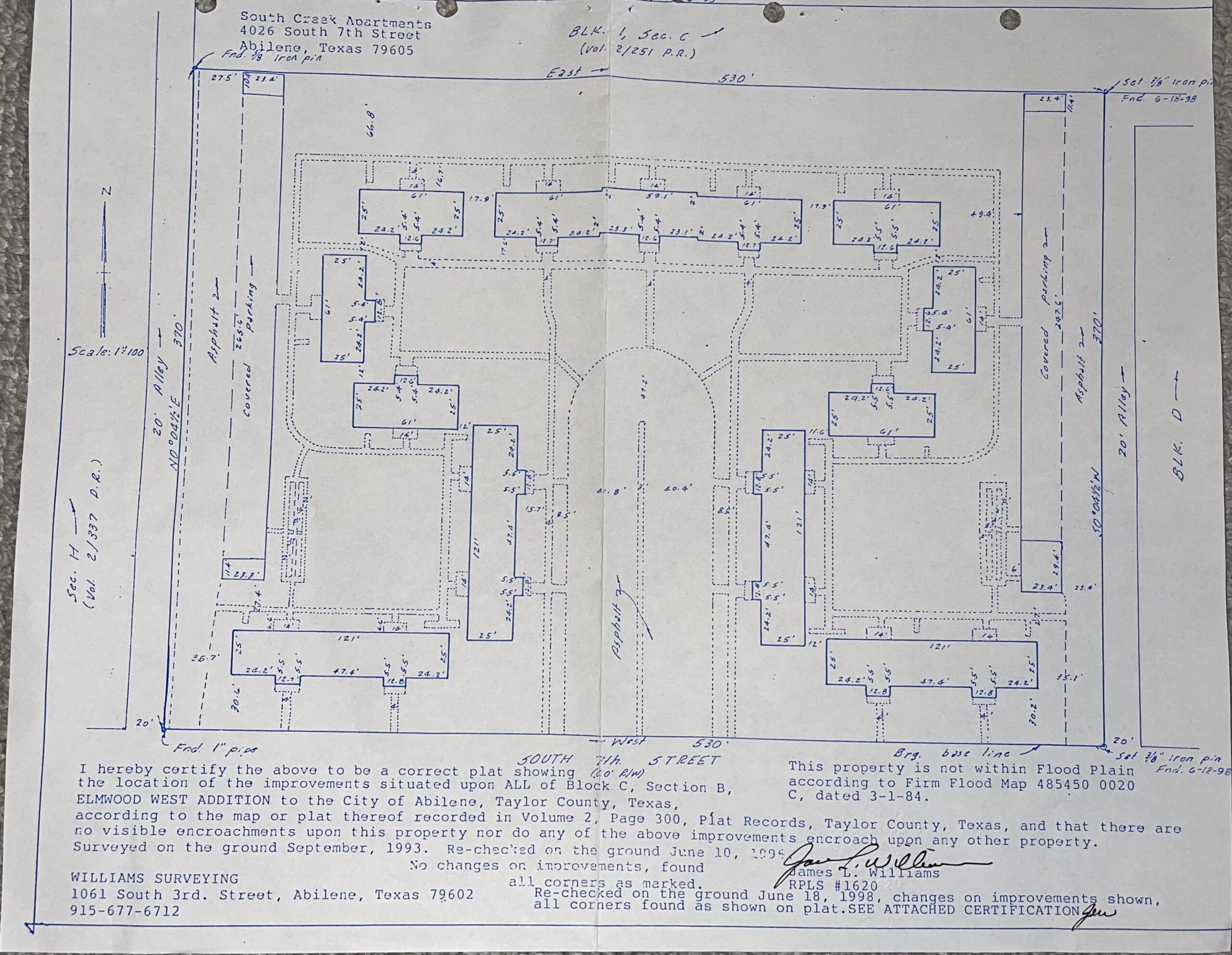

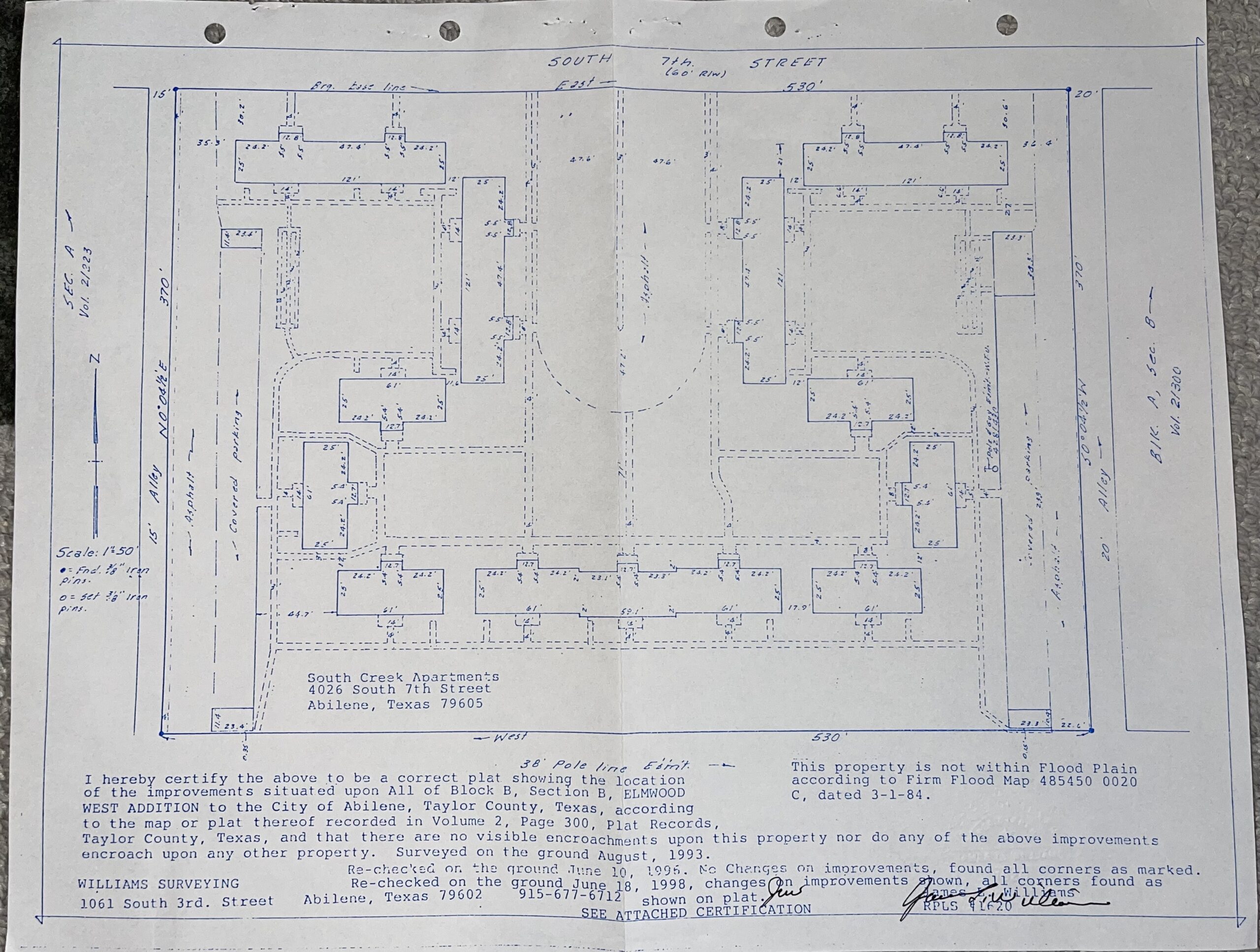

- High-visibility site divided by S 7th - a major east/west arterial that connects Treadaway to the east and Arnold Blvd / Dyess AFB to the west. Property in three parcels Taylor CAD PID 61928 - 4026 S 7th St on the north measures 4.5018 acres with 11 buildings and 2 carports with storage; Taylor CAD PID 61810 - 4025 S 7th St on the south mirrors the north campus with 4.5018 acres improved with 11 buildings and 2 carports; Taylor CAD PID 58483 - 4065 S 7th St on this southwest corner of the development adds an additional 0.7083 acres for a total of 9.7073 acres.

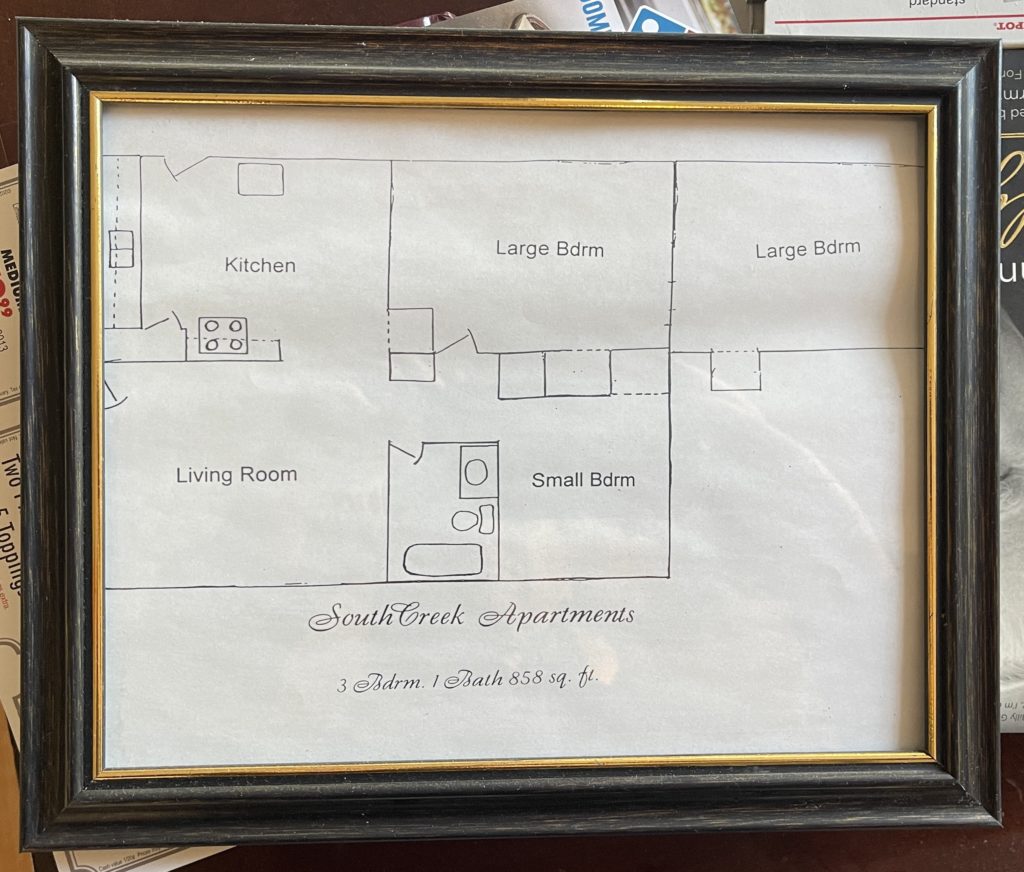

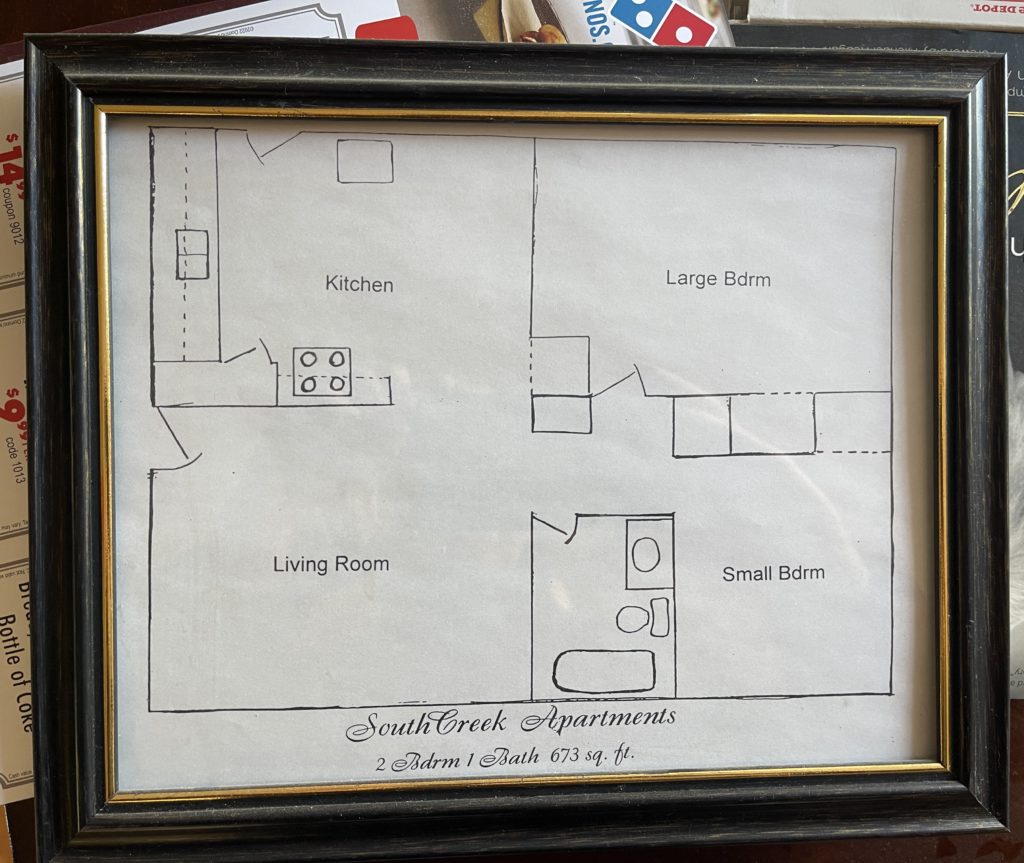

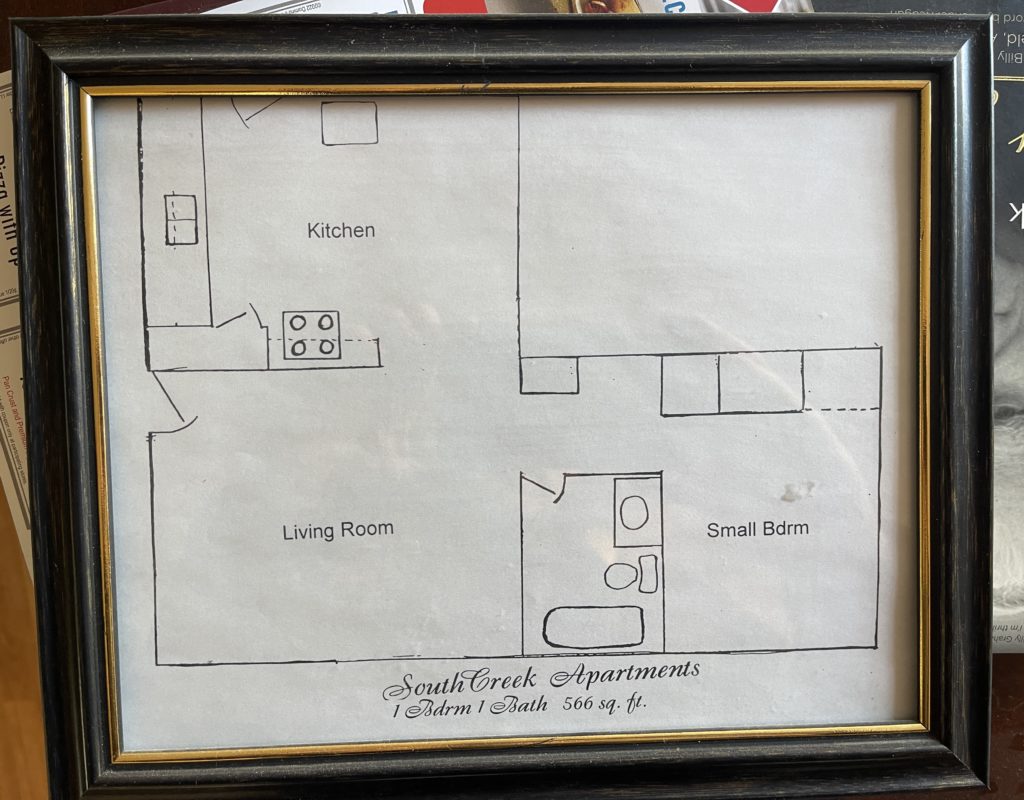

- Unit mix of 18, 568-sf one bedrooms, 104, 673-sf two bedrooms, and 12, 858-sf three bedroom units in 22, 2-story buildings.

- Average unit size: 689 sf. The 22 buildings are split into a north campus (11 buildings, 2 carports with storage) and south campus (11 buildings, 2 carports with storage) by S7th St. and mirror each other in layout.

- The buildings are wood frame, with painted brick exteriors and pitched roofs. Original windows are single-pane casement windows. HVAC is a combination of wall furnaces and window units. Each unit is separately metered for electric. Each building also has house meter for exterior & stairwell lights. Two gas meters - on the north campus; one on the south campus - provide common gas for the units. Water is provided via multiple common meters.

- Four laundry facilities external to the units are on property - one on the north side of the campus, one on the south. These laundry rooms are currently used for storage.

- 88 covered parking spots and 112 uncovered parking spots are available on the interior and exterior of campus - an average of 1.5 spots per apartment.

- An offering memorandum that summarizes much of this information is available in pdf form. This is information is also available on the Crexi link that includes financials.

Property details

The Meadows has 26 structures on property - 22, 2-story buildings and four bays of covered parking each with cinderblock-constructed common laundry rooms that have been repurposed for storage. The numbers on the initial image represent stairwells in each building. Each stairwell provides access to 4 apartments. The center buildings at the top and bottom of the image have three stairwell or 12 units. The eight buildings closest to S 7th have two stairwells or each building has 8 units. The three buildings on the NE, NW, SE, & SW corners that have a single number are 4-unit buildings. The office is located in two units at 4026 which brings the unit count to 134.

Here is a link to a completed property disclosure statement for more information about the property.

The album of property photos below are of all improvements and were taken 12.29.2022. The are to give potential investors an idea of occupancy and the condition of each structure on the property. Photos of installed electric meters indicate the number of units with active (or potentially active) electric service.

These 220 photos reveal considerable deferred maintenance across all improvements. A serious investor needs to consider budgeting for:

- Windows - All windows are original casement windows that have been modified to accomodate window units. In some cases, damage to windows call for full replacement.

- Doors - rear doors have glass panels which have been damaged resulting from unauthorized access to units.

- HVAC - the lack of marketability of gas heat and window units for cooling suggests that an investor converting to central HVAC or split units.

- Exterior - Despite their age, most of the buildings appear to be in good structural shape. Photos indicate that brickwork on several buildings have succumbed to settling across their 59-year life span. Several buildings have mismatched paint and deteriorated woodwork at the soffit.

- Utilities - water and gas are provided with a common meter. If an investor commits to a major rehabilition of the property, it would be worth considering terminating gas service and go all-electric. To do this, service panels must be updated to accomodate appliances previously powered by gas. Alternatively, reviving gas to units that have been without gas for some time will require its own set of expenses.

- Plumbing - if a major rehab is part of the plan to stabilize this property, it would seem this is the time for a replub of each unit. If possible, in-unit washer/dryers seem preferable (for tenants and investor income) versus to a return to less-desirable, somewhat functionally obsolete common laundries.

- Roofs - a roof inspection by a licensed property inspector in Summer 2022 indicated that all roofs are in fair condition. The last city permit for roof work was pulled in 2012.

- Parking - the parking lots are fair. It appears that years have passed since they were last blackcoated and sealed.

- Landscaping - the campus has a dense thatch of bermuda grass, some established trees, and hedgerow remnants in different parts of the complex. The greenspace between each building adds to cost and options might be considered to downsize or xeriscape grassy outdoor spaces.

- Interior - the property's age along broken windows and doors indicate that interior expense for everything from flooring to appliances packages must also be considered. Several units on property have been affected by fire or water, stabilized by maintenance, and left unrepaired.

- Occupancy - A new owner needs to be confident in their plan to restore occupancy for this investment. Six of 22 buildings have no in-place unit meters - only active house meters - indicating these buildings have been vacant for some time. Less than a third (41 of the total 134 units) have installed residential meters. This speaks to the repairs to image must take place coincident with physical repairs to make these units viable.

- The disclosure statement for 4025/6 S 7th reiterates some of these issues.

All that acknowledged, The Meadows has multiple advantages:

- The Meadows is a large, centrally located apartment complex. It is adjacent to a neighborhood retail center with occupancy around 90%. You are a 2 minute walk from a Dollar General, 24-hour gym, karate studio, antique mall, a Thai food restaurant, a local coffee shop that serves lunch and dinner, vintage record shop, recording studio, professional services including insurance, property management, and accounting along with multiple hair/nail salons. Bonham Elementary is 0.4 miles - an easy walk with crossing guard - from The Meadows.

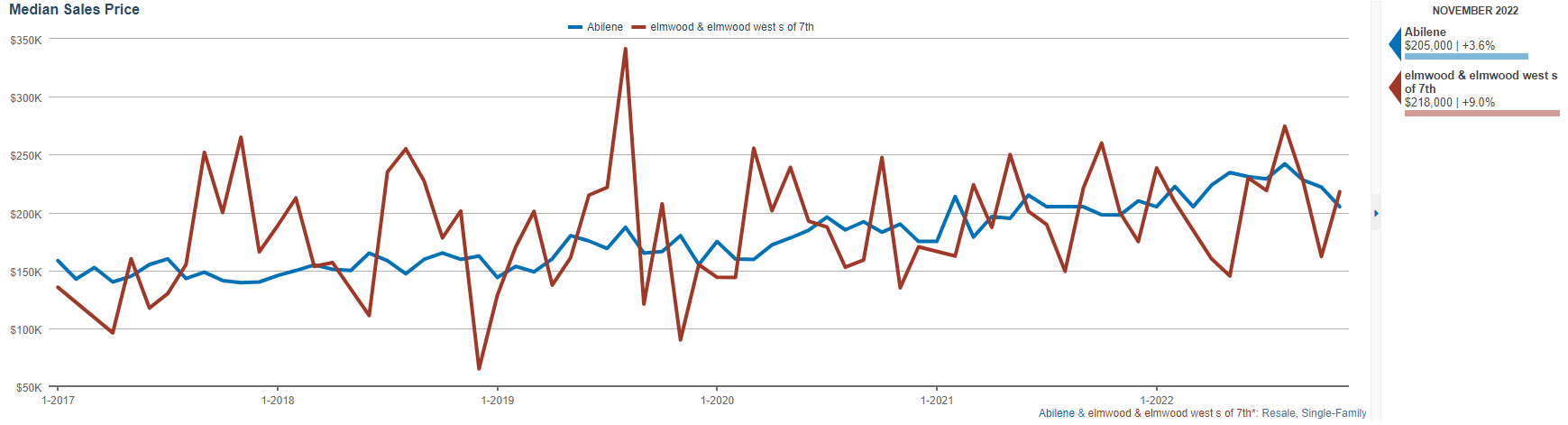

- While The Meadows is below-market in terms of condition, the surrounding neighborhoods - from historic Old Elmwood to the east and contiguous Elmwood West - continue to maintain value consistently at a pace with the median value of Abilene single-family residential sales realized over the last five years.

- Positioned at the intersection of two arterial streets - S. 7th and Leggett - the property benefits from high visibility. Efforts to rehab the property will not go unnoticed and daily street traffic will make it easy to market using on-property signage.

- Current occupancy rates don't allow management to charge for covered parking, but when occupancy rates are improved, an opportunity exists to price covered parking as an amenity to tenants.

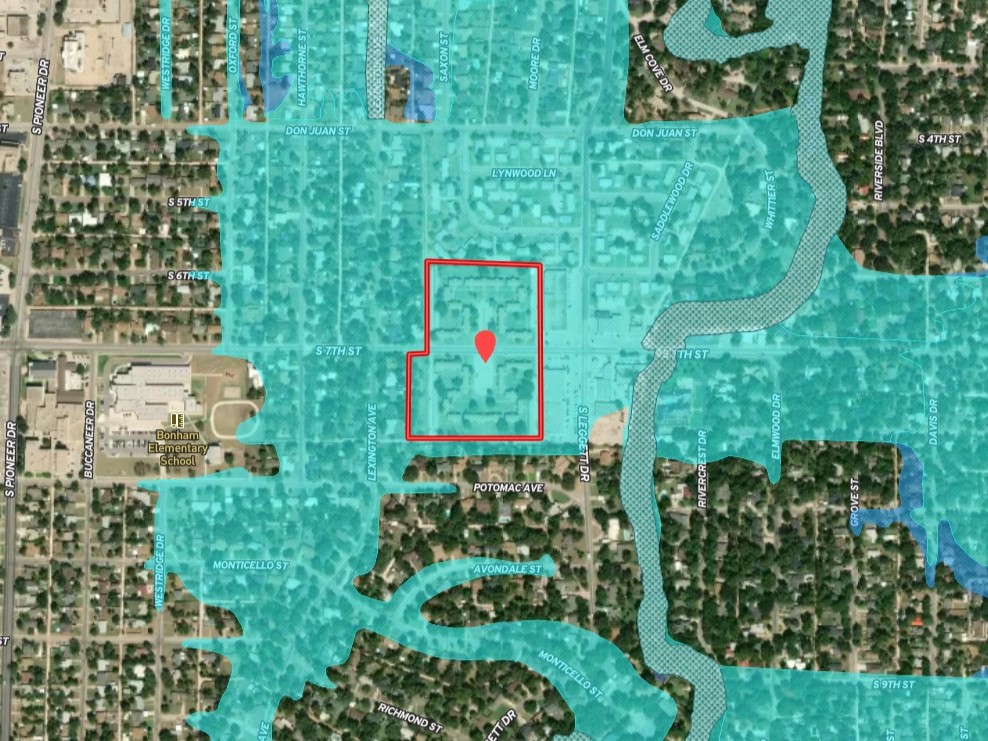

- This is a mixed advantage, but The Meadows is sited in the 100-year flood plain. This means that new development will require site elevation to be built. This acts as a barrier to new development in the area, protecting this asset from competition. If an investor was looking for complete control of this sub-local market, the 146-unit, 1950's vintage duplex development to the north of The Meadows is currently offered for sale as well.

Financials

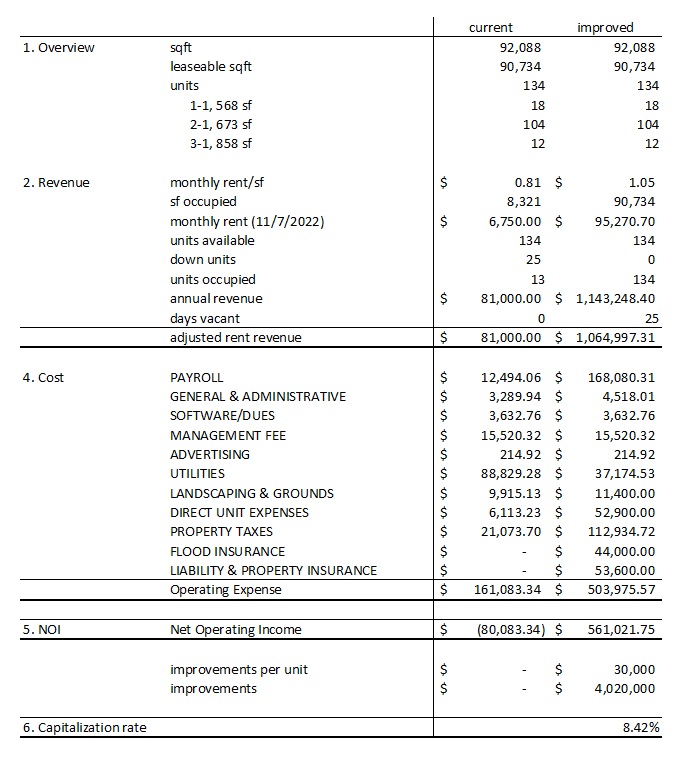

There were 13 occupied apartments at The Meadows in December 0f 2022 - an occupancy rate just under 10%. Rent for these occupied units is below market at $0.81/sf. Currently, limited services are provided to tenants and considerable assumptions need to be accepted to generate a proforma for a stabilized & renovated property.

The income statement below takes elements of the current financial story for this property and generates a post-renovation proforma with a cap rate of 8.42%. In this proforma, it is assumed:

- A gain in wages and salaries with a maintenance staff of two and an office staff of two.

- Property, flood and liability insurance was not available for the current income statement.

- Property taxes and insurance will increase to reflect revised valuation for the property.

- Direct unit expenses will rise to reflect a 93% occupancy rate.

- Purchase prices is $2,640,000 and this is a component of proforma property taxes.

- $30,000 per unit will be spent in renovations and this improvement will become a component of proforma property taxes.

Abilene Rental Market

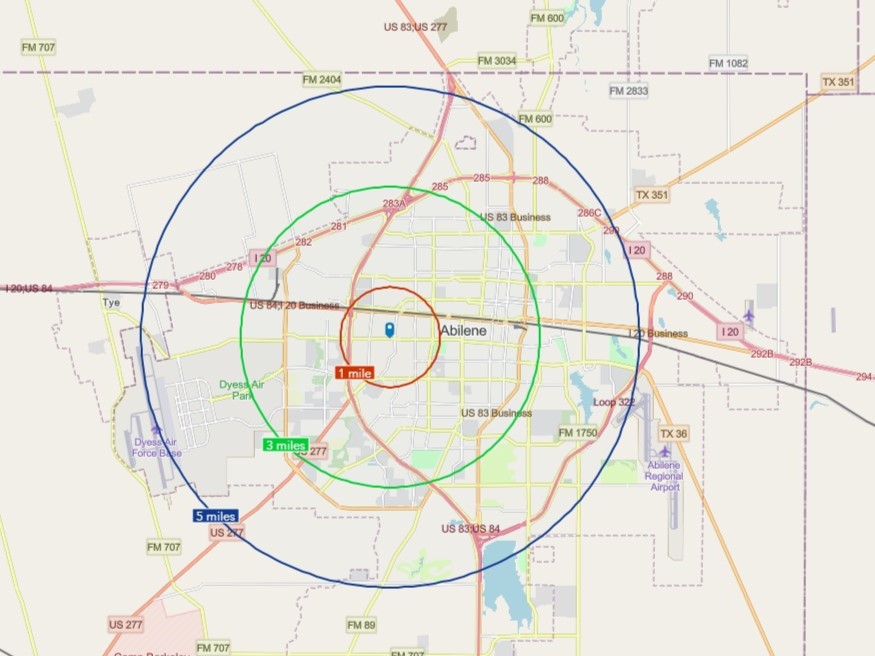

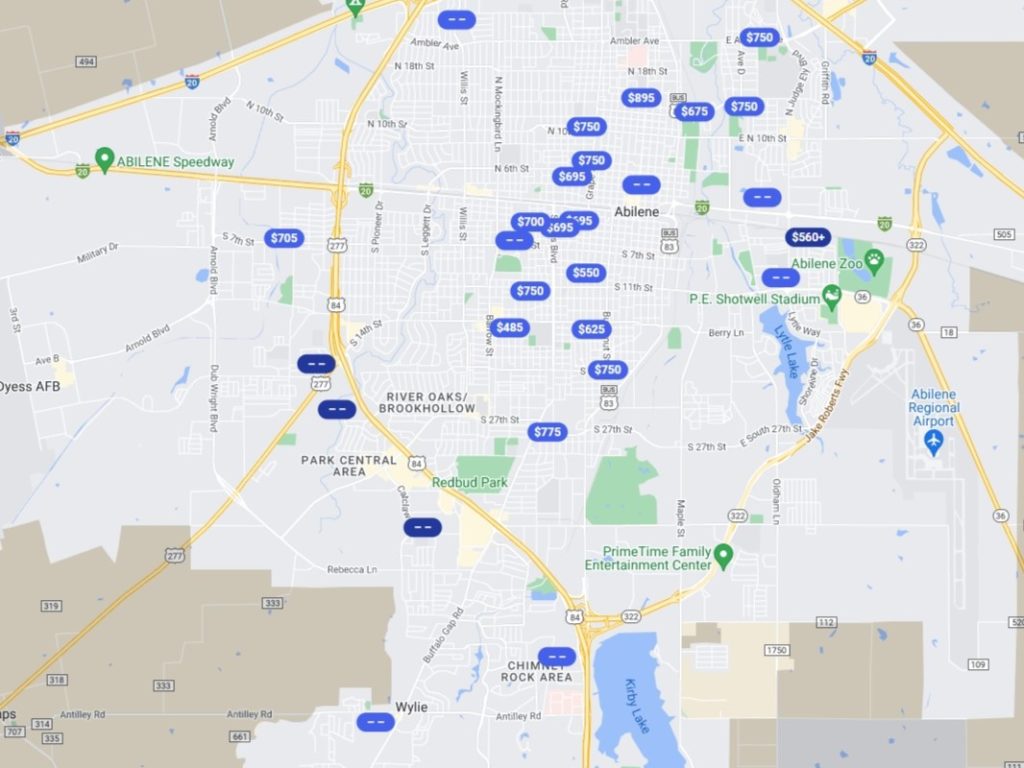

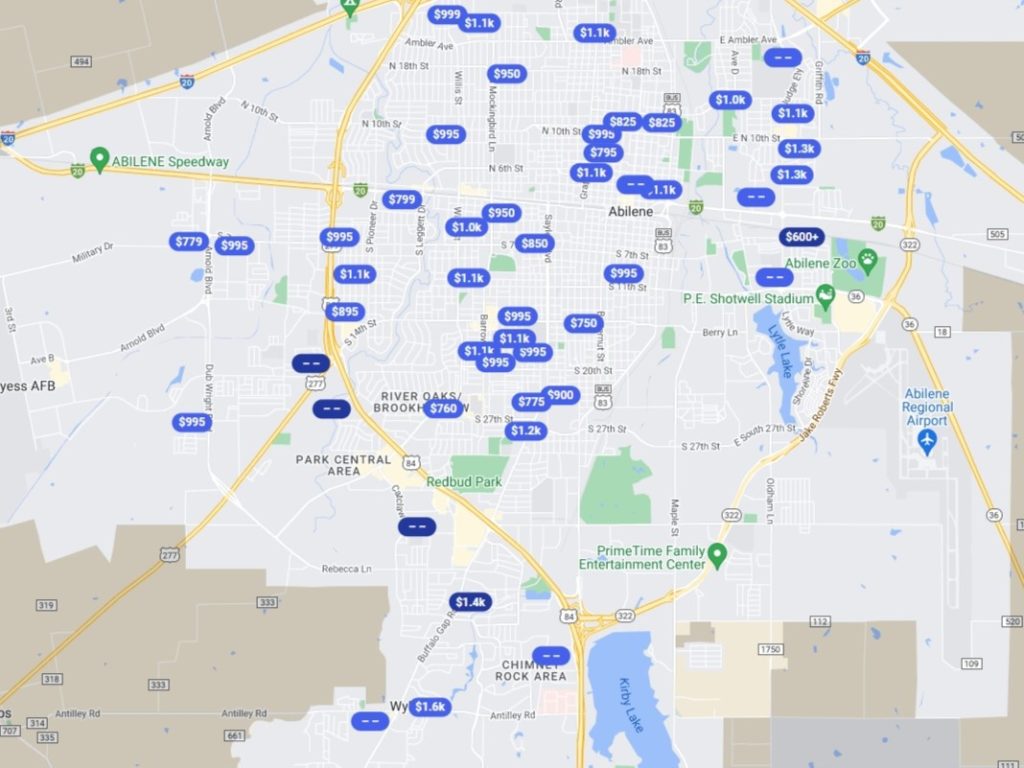

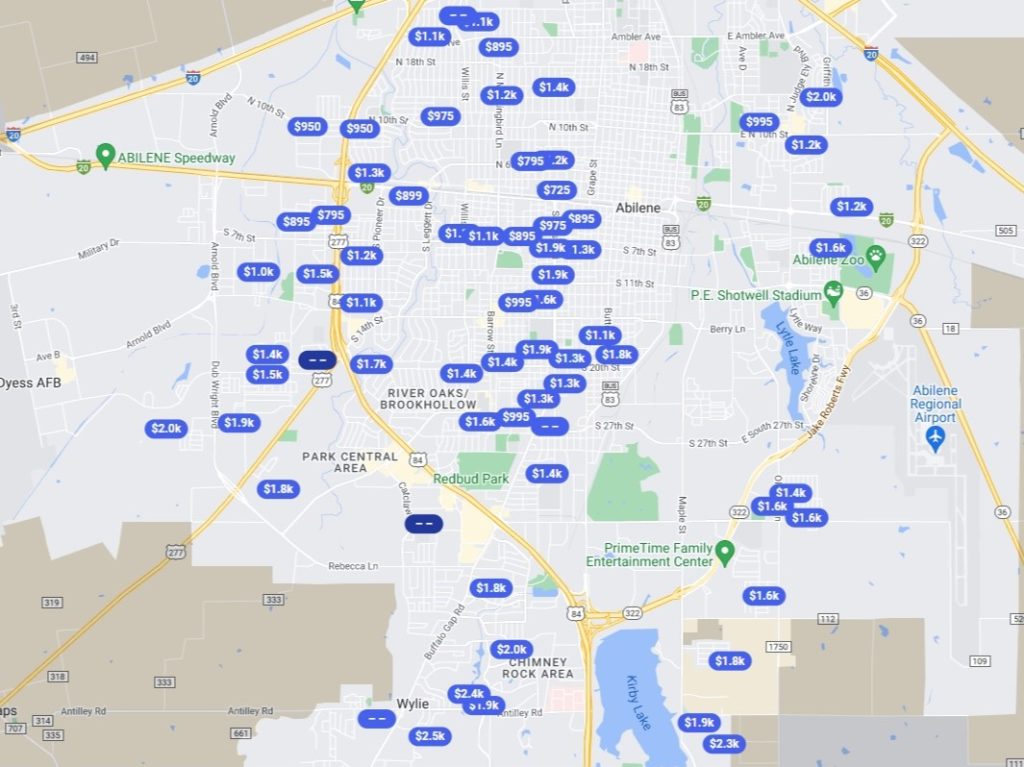

The Meadows is a mix of 1, 2, and 3 bedroom units. These maps show Abilene area rents for these floor plans at other properties. Local apartments leased through MLS average $1.04 per sf in monthly rent.

Abilene Demographics & Economy

- This link makes available a comprehensive demographic report for Abilene in pdf form. It references multiple data sources and is typical of market demographic reports readily available on the internet via paid services.

- The Abilene, TX MSA encompasses 2,750 square miles with population of 172,000 in three counties (Callahan, Jones, and Taylor) in west central Texas.

- Abilene, with a city population of 125,000, is ranked 28th in population for the state. Abilene is positioned 120 miles west of the Dallas-Fort Worth metroplex via interestate, 180 miles northwest of Austin via two-lane roads, 160 miles southeast of Lubbock via interstate and 150 miles east of Midland-Odessa. The City of Abilene is the county seat of Taylor County and the most populated and principal city of the MSA.

- Abilene consistently ranks as one of the most affordable places to live in the U.S., with a cost of living 9% lower than the national average.

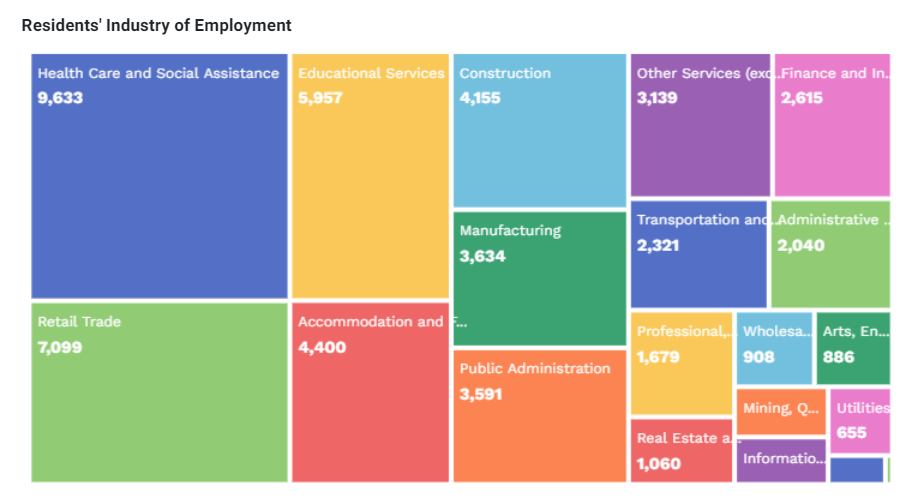

- Abilene’s economy is driven by institutional money. The benefit of this economic ballast is stability. Other markets more dependent on technology, finance and manufacturing see more pronounced periods of boom and bust. In contrast, the funding for these Abilene institutional employers - the federal goverment, local tax dollars, guaranteed student loans, Medicade/Medicare - are consistent and bring stability to a large share of Abilene's employment story. Institutional employment is derived from:

- Government

- Higher education

- Medical

- Secondary to the institution component of the Abilene economy is its financial and manufaturing sector. First Financial Bank is headquartered in Abilene, a regional bank found in all nearby cities in the Big Country region and nearby major cities. The manufacturing and food processing sectors are diversified in beverages, large-scale bakeries and tortillas, cheese manufacture, renewable energy, animal foods, engine, turbine & power equipment, architectural & structural metals, industrial boiler, tank & shipping containers, boat production.

- Undeveloped, open land in Abilene provides opportunities for major business development. The Development Corporation of Abilene - a 4A funded development corporation - focused exclusively on primary job creation - complements private economic development with guidance and development dollars to continue to expand the Abilene economy.

Property Tour & Offer Process

Property Visitation

Prospective purchasers should contact listing agent to schedule a property tour. Tours will include access to a representative sample of units as well as common areas. To not disturb the Property’s ongoing operations, visitation requires advance notice and scheduling.

Available Tour Dates

To schedule your tour of The Meadows, please contact John Hill at 325.721.4428 or john@barnetthill.com.

Offer Submission

Offers should be submitted in the form of a non-binding letter of intent to John Hill at john@barnetthill.com. This property is also listed on Crexi and you can use their LOI as well. Hill can be reached by phone at at 325.721.4428. Terms and conditions of Purchasers’ offer should at the minimum include:

- Offer price

- Defined feasibility period with option fee

- Earnest money deposit

- Description of Purchaser qualifications and proof of funds

- Identify buyer's representation if using representation apart from listing agent. Buyer's representation will receive 1% of sales price as commission.

- Title work has already been executed by Big Country Title, 3409 S 14th St Suite 110, Abilene, TX 79605. Buyer is expected to use this title company as escrow agent.

- This seller has multiple properties for sale and expects Buyer to pay title insurance and survey as she does not have one. Please include your willingness (or absence of) to pay for the title policy and survey in your letter of intent.