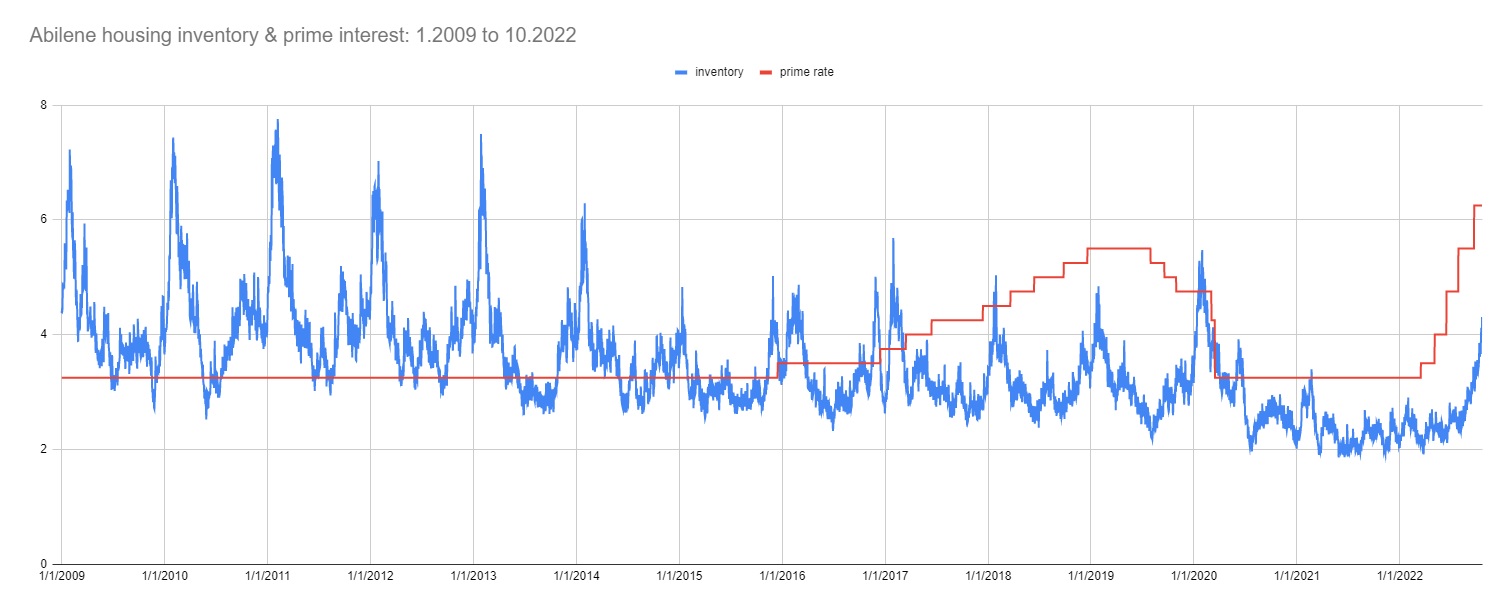

In response to historic inflation sponsored by unchecked COVID transfer payments, the Federal Reserve Bank initiated policy in March 2022 to bring inflation under control. A visible component of this policy – especially to anyone involved in real estate – is increased interest rates. Mothballed phrases like “buying points” – unuttered since prime rates dropped and stayed at 3.25% throughout most of the last decade – are back in vogue with real estate agents trying to ink deals on listings with growing housing inventory [1].

Since the government embarked on interest rate increases, Abilene inventory has mirror national trends in its expansion. On the day prior to the quarter-point prime rate increase on March 17, 2022, Abilene housing inventory stood at 2.08 months worth of stock. Subsequent to this year’s five rate increases, housing inventory climbed throughout 2022, recently doubling that figure with a little more than 4 months of inventory [2].

So… 4 months of inventory and climbing with more interest rate increases likely to come. Not to get mired in the present, I looked at historical data on housing inventory to lend long-run context:

- In Abilene, we have to go back to 2014 to see inventory above 6.5 months and, even then, +6.5 months of inventory only occurred in January – a time in the calendar acknowledged as a slow time for real estate transactions. These periods of neutral inventory were short-lived and inventory quickly returned to a position that benefitted sellers. Unlike current conditions, those blips took place during a prolonged period of 2% inflation and prime rates at 3.25%.

- Following 2014, a recovered economy with predictable 2% inflation gave the government the green light to raise rates, ultimately, to 5.5%. A rate reversal was initiated in July 2019 and the following January saw inventory momentarily climb above the winter spike realized in 2018 and 2017 under these higher interest rates.

- COVID hit, people sheltered in place and were afraid to put their homes on the market or look for a house, inventory climbed to 3.92 months in June 2020, the prime rate was cut to 3.25%, and PPP money was infused into the economy. The result: as we learned to live with pandemic conditions, we saw sub-2 month inventory occur 50 times between January 2021 to March 2022 and we experienced the most persistent seller’s market seen in years.

This graph of Abilene inventory and the prime rate [3] summarizes these three periods of Abilene, single-family home sales. It visualizes the secular, annual swings of inventory during flat, low rates prior to 2015, dampened inventory swings once rate increases begin in 2015, rates plummeting with COVID in 2020, and a supercharged market with low rates & PPP money that kept inventories low until the stimulus money ran out, loan deferrment sunsetted, and rates begin to climb.

- Square footage – larger homes, bigger price.

- Age of home at date of sale – the older the home, the lower the value of the home.

- Age of the home at date of sale (squared) – this polynomial transformation measures gentrification. True, older homes lose value, but as they age, trees get bigger, neighborhoods become more established, and values increase.

- Unexempt property taxes – A problem with age, especially old age, is that it fails to measure a home’s condition – you can have two homes of the same age where one is old and decrepit, and the other is old and well-maintained. Using unexempt taxes presumes that an agent of the tax office lays eyes on each property and judges its condition on a spectrum from excellent to poor. This allows unexempt taxes to serve as a proxy for quality.

- Lot size (measured in acres) – the larger the lot size, the larger the value.

- Pool (Y / N) – a swimming pool adds value.

- Number of stories – a second floor decreases value, a third even more so. People in Abilene don’t like to climb stairs.

- Wylie ISD – Wylie ISD adds value relative to Abilene ISD.

- Mandatory HOA – an HOA is an additional agent that maintains quality of a neighborhood and adds value.

- Half baths – a half bath is a proxy for higher-end construction and adds value.

- Number of garage stalls – this adds value as people appreciate protection afforded by an enclosed garage. This is not the same thing as carport parking.

- No HVAC – no HVAC suggests a total gut job and subtracts value.

- Flooring – luxury vinyl plank (LVP) indicates the home owner updated their home. Wood floors are timeless and what LVP hopes to be (even though LVP helps the house sell for more than wood). Carpet suggests stains, odors, and an outdated home, negatively impacting price.

- Number of months inventory – every month of inventory added gives advantage to buyers by decreasing price.

A linear regression model explaining sold price was performed that considered each of these factors. The model estimated that a 1-month gain in housing inventory drops price by, roughly, $15,000. The same home on the market in October 2022 (using inventory measured on 10/20 of 4.3) lost almost $34,000 versus what it could have sold for if it went under contract on January 1, 2022 (inventory 2.08 months).

I'm not sure if offers any comfort to sellers with homes on the market, but his begs the question: what level of real estate inventory makes a neutral housing market. By neutral market, I mean a level of housing inventory that gives neither a seller nor buyer the upper hand. The Texas Real Estate Center at Texas A&M offers 6.5 months as neutral inventory. We aren't there - yet.

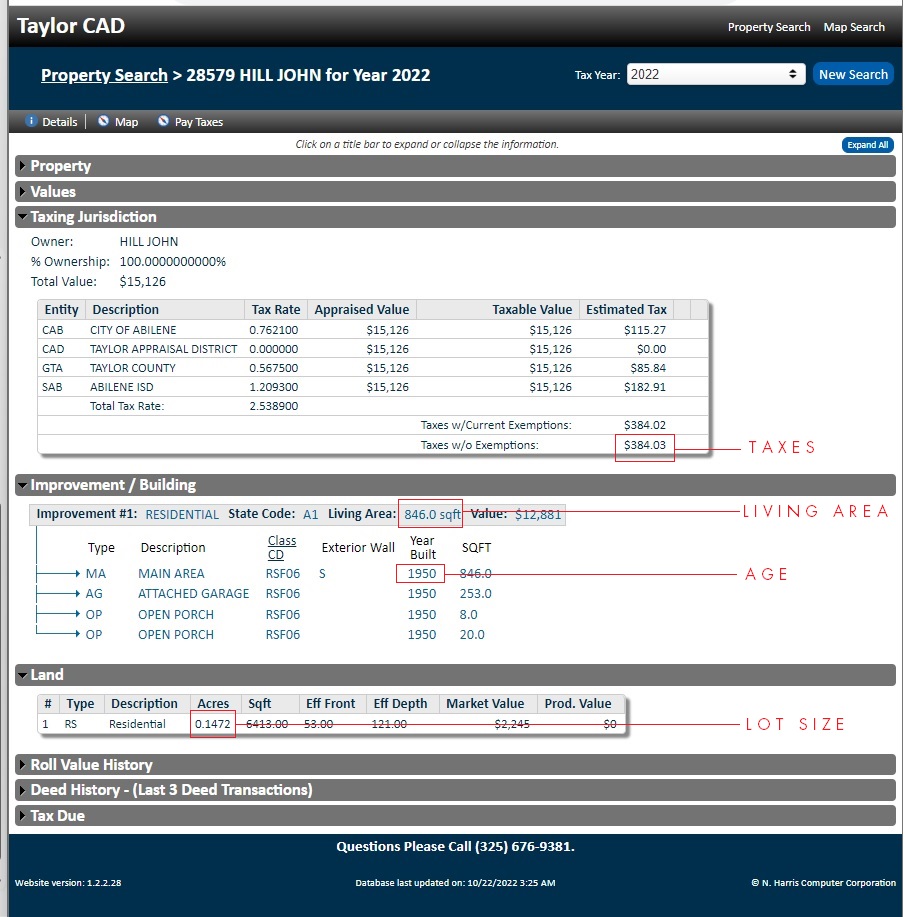

Curious how these current market conditions have affected the value of your home in Abilene? The results of this econometric model that translates inventory to price has been used to develop this pricing tool. To use it accurately, you'll need to perform a little leg work and search your property record on the Taylor Central Appraisal District website to get your 1) unexempt property taxes, 2) living area, 3) age, and the 4) lot size of your home. Once you've entered the information for your home, you can noodle with the inventory date to adjust months of inventory and make tangible your angst that you didn't take advantage of 2021's robust market conditions.

A caveat: this tool is a good first pass at value, but it may not be YOUR value. Understand that each house is unique and you need a real estate agent to assess the qualities of your home in the context of today's market conditions to monetize these differences when you buy or sell.

Ready to sell? Call a Barnett & Hill agent to begin pricing your home to get it sold. Ready to buy? Call a Barnett & Hill agent who can leverage data like this to help you fight for the best price on your new home.

[1] The number of homes that are actively on the market divided by the number of homes that sold in the last month is the formal measure of inventory. For example, if 400 homes are on the market and 100 homes sold in the last 30 days, inventory is 4 months. This statistic suggests if consumers take down 100 homes per month, there are enough homes on market to sustain 4 months of purchasing.

[2] Typically inventory measures are summarized each month, yielding 12 snapshots per year on inventory. In this market where inventory is responding to changes in interest rates, 13 years of data was downloaded from NTREIS to develop a daily measure of inventory. This measure is based on a 30-day average of active, active-option, active-contingent, and pending listings divided by a total of closed sales over the same 30-day period.

[3] Federal Reserve Bank of St. Louis, Bank prime loan rate , https://fred.stlouisfed.org/series/DPRIME

[4] North Texas Real Estate Information System, proprietary data at https://ntreis.net/

[5] Federal Reserve Bank of St. Louis, Consumer Price Index for All Urban Consumers: All Items in U.S. City Average, https://fred.stlouisfed.org/series/CPIAUCSL