by John Hill

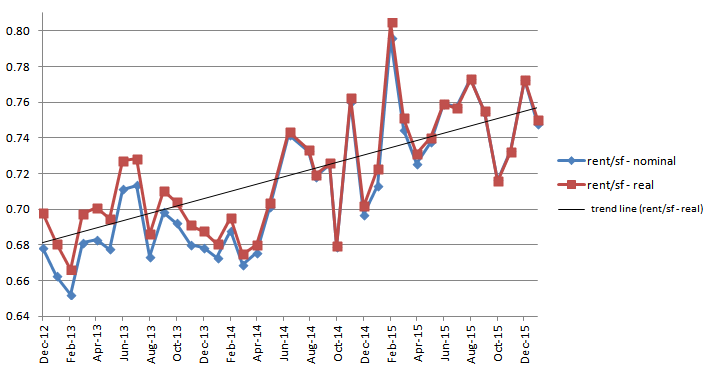

Barnett & Hill has reported rent statistics since December 2012. Looking back over this 3-year period, we’ve observed little variation in rent prices for single-family homes in the Abilene market.

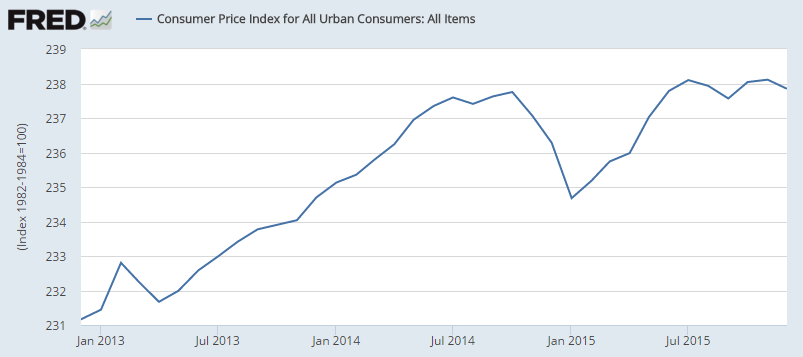

To add a layer of context to this flat data, we looked at inflation and the real value of rent. To define: rent is reported in nominal terms, i.e. it does not account for the annual creep in prices measured by the Consumer Price Index (CPI). We used CPI data in tandem with historical rents to gauge how rents have risen since December 2012 and convert these numbers to inflation-adjusted or real terms.

Historically, we are accustomed to a steady creep in inflation; a 2-3% annual gain in inflation doesn’t surprise most people who watch prices across time. The events that took place in 2008 changed this perception and, even in 2012, the impact of the 2008 financial crisis and tepid international markets diminished or reversed inflation. This graph shows inflation trends across the period of comparison:

Now consider Abilene rents. A visual scan of nominal rents shows the best month for rent in February 2015 at .80/sf and the lowest rent in February 2013 at .65/sf – a .15/sf difference which would add $180/mo in rent to 1,200 sf home. As a sidebar, oil was $90/barrel in February 2013 and $50/barrel in February 2015 – no good smoking gun there as to cause-and-effect.

To calculate a temporal trend to nominal rent, we used a log transformation of rent/sf and regressed it against the passage of time to calculate the percentage change in residential rent per annum. Based on nominal data, rent has increased annually .14% during this period. Performing a second regression of the natural log of real rent against the passage of time reveals a smaller annual increase of .11%.

A few observations:

- Nominal rents are flat and, even when adjusted for recent inflation, stay flat. Landlords aren’t gaining in real terms, but they aren’t losing either.

- Flat rents provide a barrier to entry to the Abilene rental market. Even at .80/sf, it’s difficult to rationalize a game-changing addition of new construction where rents can substantiate the outlays.

- New landlords should demand cash flow – there is no appreciation upside.

- We aren’t in an oil market, fracking has juiced supply which has been compounded by unstable nations with nationalized oil who use their reserves like profligate heir with a trust fund and drug habit. Combine that with a weak international economy and years of fuel efficiency measures and you lose the one thing that can bring action to our economy that is built off student loans, Medicaid/Medicare and federal defense dollars.

- On oil: our best rent happened when oil was cheap; our worst rent/sf when oil was expensive. This is one of several statistics we’ve seen that show Abilene benefits from low-cost oil because it gives the average workers more purchasing power.

I make none of these observations to be grim, rather, each provides a unified message of good news to landlords – and certainly those landlords that are already in the market – enjoy those barriers to entry. When oil was $100/barrel, Midland/Odessa enjoyed doubled rents and doubled rents bring new product to the market. When the oil tide rolls back, employment ebbs, leaving older properties sitting vacant and all landlords making rent concessions in the face of declining demand. Our point: you may not get rich overnight as an Abilene landlords, but slow and steady has its place in any investment strategy.

Leave a Reply